Sometimes both foreigners and Thai companies consider the merits of owning property either under a company structure or an individual. There are a few pros and cons to owning a property via a company versus an individual which we explore in this Flash.

On-going operational tax advantage

A corporate structure can allow the depreciation of the building over 20 years, and this will reduce the book-value of the property and create a loss on the property that can be used as a tax credit on rental earnings. If you live in the property yourself, you should also pay a rent to the company.

If the land and building value increases overtime while depreciating the building reduces its cost value and the land is appraised according to the government, then the market value could become higher than the cost that is booked. This means that the company will need to pay corporate income tax on the difference between the sale price and the lower cost price. Therefore, unless you plan to keep and maintain the building for many years then you need to weigh up if there is any ongoing tax benefit for you by owning the property via a company especially if you plan to live in it.

Costs of Setting up a Company

There are costs involved in setting up a company and arranging a legally workable shareholding structure. There are also ongoing costs such as accounting fees and tax submission. A company is also less likely be able to obtain a mortgage than an individual and might not be able to secure bank loans if there isn’t a real business besides renting the property to yourself. Paying cash for a property can tie up capital resulting in an ‘opportunity (lost) cost’ while the only benefit is that you can have a degree of control by having a company that can purchase land.

Shareholding Structure

A foreigner can hold 49% of a Thai company and have two or more Thai shareholders holding 51%. MBMG’s legal team says that there are legal means to achieving an outcome that might work for you.

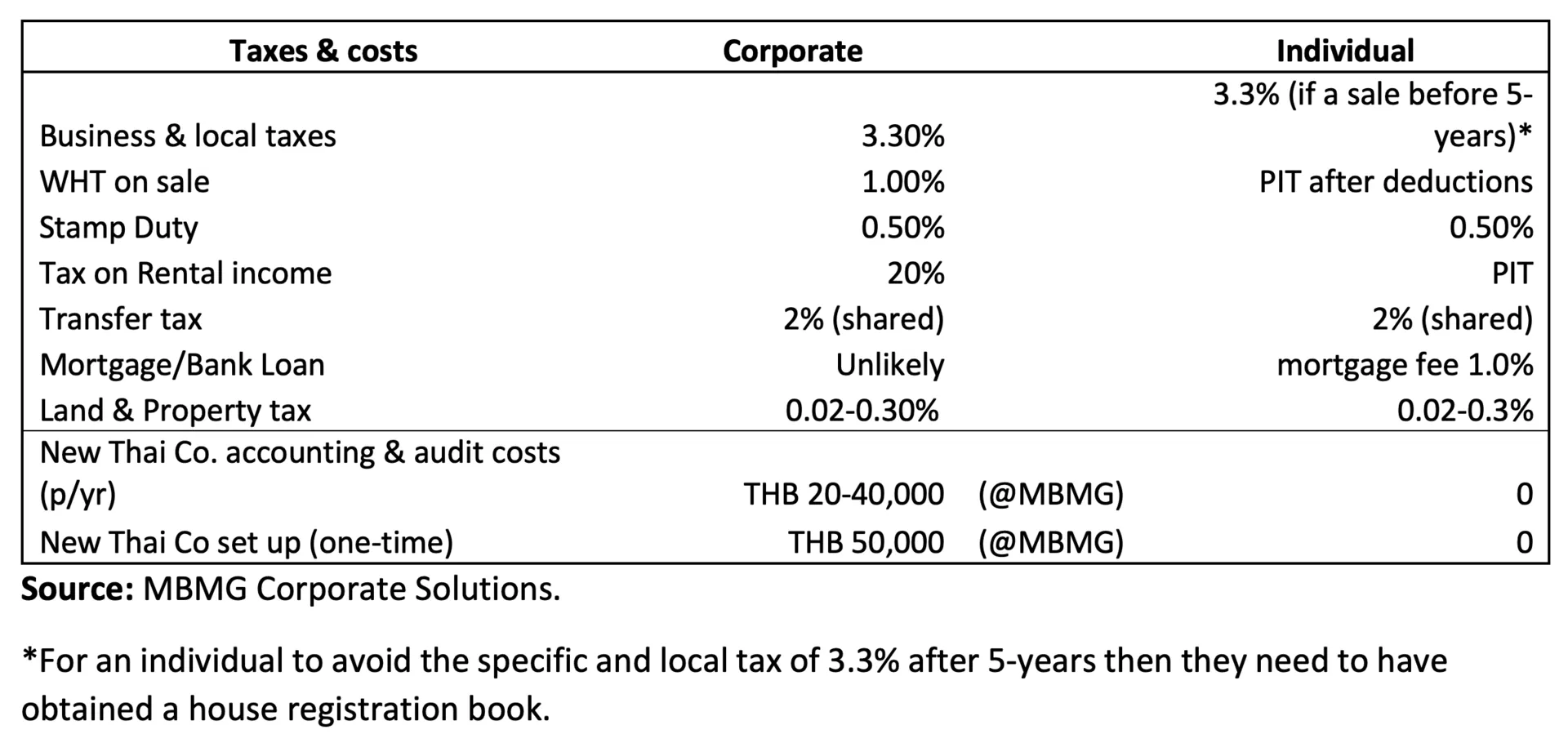

Comparison of Property Asset Taxes for a Corporate and an Individual

The key Tax Advantage of an Individual versus a Corporate

The only tax advantage of individual ownership when it comes to the sale of a property is if the property has been registered with the local authority and the owner has the registration book. In this case, the individual won’t be subject to the business and local tax of 3.3% of the appraisal value or selling price of the property (whichever is the higher).

Mortgage Advantage for a Permanent Resident

For many people the key advantage of individual ownership of a property is the ability to obtain a mortgage often at an attractive rate compared to a typical lending rate at the time. In Thailand. A foreigner with Permanent Resident (PR Certificate) can apply for a mortgage from a Thai commercial bank. The mortgage fee in Thailand is regulated and is 1.0% of the mortgage and this is non-refundable even if the mortgage is soon afterwards paid-up.

A Closer Look at Property Transaction Taxes

:Transfer Tax: The Thai government imposes a fixed transfer fee of 2% of the sale figure when purchasing or selling a property and this fee is usually shared between the buyer and seller (at 1% each).

Business & Local Tax: A tax of 3.3% of the registered sale price or appraised value (whichever is higher) is handed over through the sale. This amount comprises of a Specific Business Tax (3%) and local tax (0.3%), which are applicable to the sale of immovable property or real estate which transact commercially. It should be noted that this tax is only applicable on the first five years of individual ownership by a foreigner or Thai national providing that the property is registered with the local authority as we’ve discussed above. If the property was acquired through inheritance, gifted to a sibling, the government or temple then these taxes are waived.

Stamp Duty: This is payable based on the registered value by the seller for freehold land and property at the rate of 0.5% for the company and the same is for an individual but only if they are exempted from the specific business and local tax.

Withholding Tax (WHT): For a company, there is 1% WHT that is taken at source when the property is sold. This can be used as a tax credit for the full financial year when the company comes to settle it corporate income tax.

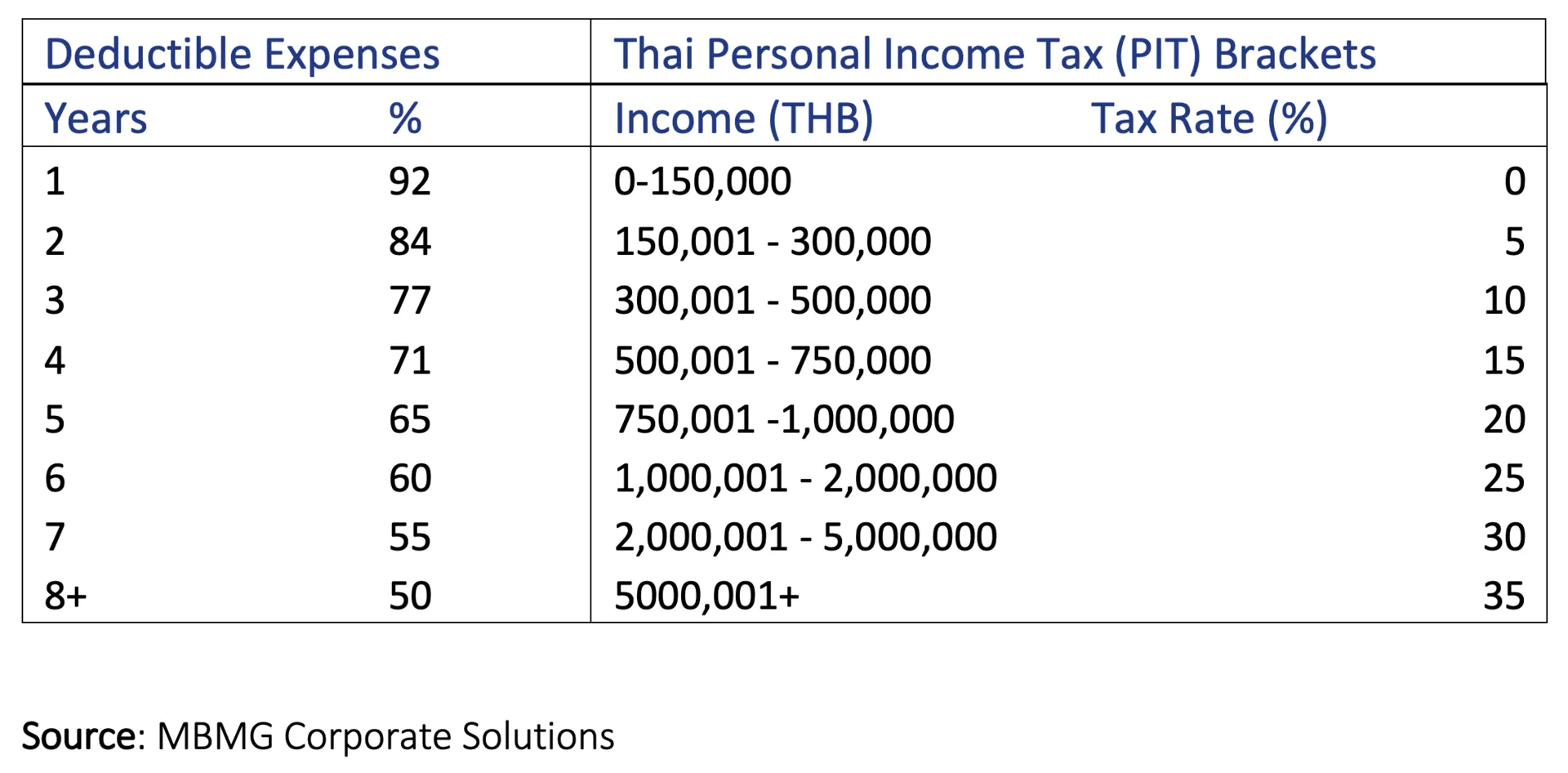

The WHT for an individual is calculated using the selling price as gross income then subtracting the ‘Deducting Expenses’ depending upon the number of years that you’ve held the property to arrive at the net income (shown in table below). Then divide the net income by the years in possession to get yearly net income. You can use this figure to calculate the ‘taxable income’ by following the ‘Personal Income Tax Brackets’. The final step is to multiply the taxable income with years that the property has been in possession to calculate total amount of WHT that you need to pay at the Land Department. Once paid then this WHT becomes a final tax on the property, and it doesn’t need to be included in your annual income return.

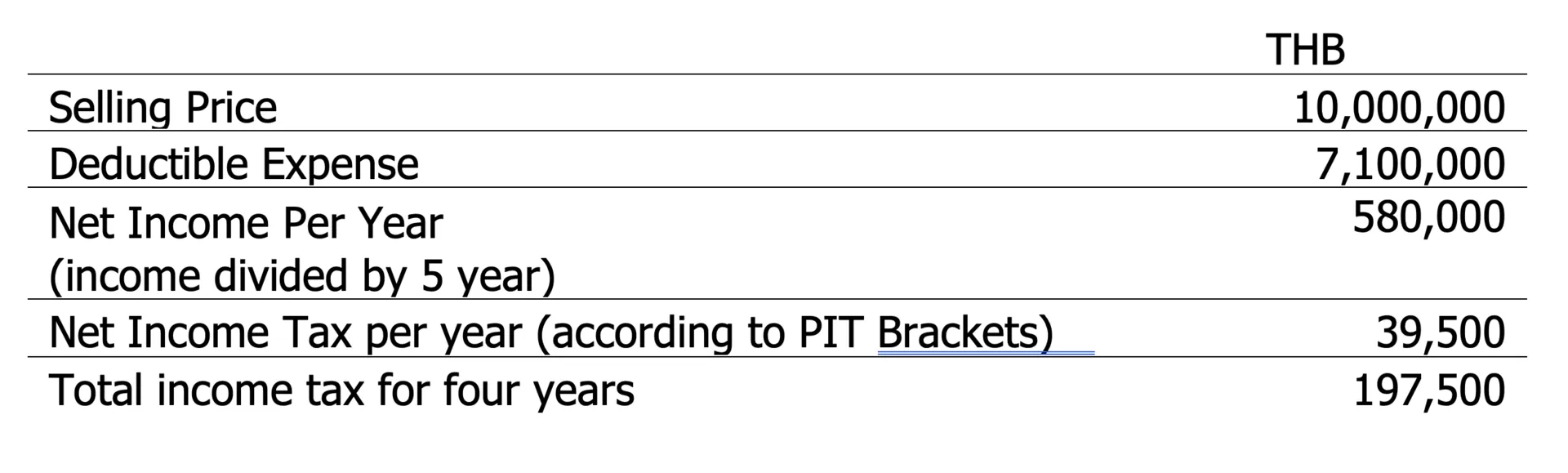

Example: Property is sold for THB 10 million.

If you sold a property and land for THB 10,000,000 as an individual then after five years you would be liable for the following withholding tax (a final tax):

Land & Property Tax -June 2022 Deadline

For 2022, Land & Property taxes for residential properties remain at a discount. There are different rates for residencies depending upon if it’s a prime residence which is registered or not, and tax rates range between being exempt to 0.1%. Vacant, unused land have the highest tax rates of 0.3-0.7% of the appraisal value. We will look at Land & Property Tax in more detail in our next Flash.

For further information please contact

James@mbmg-group.com

or

info@mbmg-group.com

Please Note: While every effort has been made to ensure that the information contained herein is correct, MBMG Group cannot be held responsible for any errors that may occur. The views of the contributors may not necessarily reflect the house view of MBMG Group. Views and opinions expressed herein may change with market conditions and should not be used in isolation.